In previous articles, I discussed Medicare and other health insurance options in retirement. One of the big myths about Medicare is that it pays for everything. Well, it doesn’t – nor does Obamacare or most other plans. In almost all cases, you will be responsible for premiums, co-pays, deductibles, and other out-of-pocket expenses, depending on your plan’s provisions.

Wise retirement stewardship includes planning for medical expenses in retirement. We trust God and pray for good health, but it isn’t guaranteed…

Beloved, I pray that all may go well with you and that you may be in good health, as it goes well with your soul. 3 John 2 (ESV)

Because we don’t know what our health will be year by year, healthcare costs are a major wild card in retirement expense planning and budgeting. It will certainly be one of the largest expenses for retirees and will vary significantly for each person as everyone’s situation is different.

Your current health (and health care expenses) is a good indicator of what your future expenses might be. If you have a chronic condition requiring regular medications, treatment, or doctor visits, or certain high-risk factors, your costs may be on the high side. If you’ve neglected your health (poor diet, lack of exercise, etc.) now is a good time for a new start – it may pay dividends as you age.

Expense categories

To get us started, here’s a list of the major medical expense categories that need to be considered:

Medicare premiums

Medicare is available to almost everyone over 65, but it’s not free. You may have to pay Part A (hospital coverage) premiums (if you do not have enough work credits) and everyone pays Part B (other medical expense) premiums. In 2016, the Part B premium for a couples $244 per month for new enrollees with documented 2014 joint income of less than $170,000. If you choose Part C and/or Part D, the costs will depend on the specific plan you select.

Medicare supplement insurance

Medicare Parts A and B will cover only about 60%, on average. Part A pays only a certain amount of your hospital bill, and that is only after you have paid the hospital insurance deductible. It pays based on what Medicare defines as “one benefit period” – and the rules are slightly different depending on the type of hospital or facility.

Part B typically pays 80% of what they determine to be the “approved charges” for a service but does not cover a number of major medical expenses, such as glasses, hearing aids, dental work, dentures, and a number of other costly medical services. (If the approved charges are less than what a doctor or other provider is willing to accept, you may have to pay the difference, up to a certain maximum.)

Because of these significant gaps in coverage, it is a good idea to purchase a “Medigap” (Medicare Supplement) insurance policy. (I touched on this in my last article, or you can read a more detailed explanation on the official Medicare site.) The really important thing to know about these policies is that coverage and cost can vary significantly across the ten different Medigap plans. (Plan F offers the most comprehensive coverage.) Each insurance company decides which Medigap policies it wants to sell in which states.

I did a spot check of some of the plans available in NC where I live and they range from $43.00 to $621.00 per month. It appears that there are a lot of good options for less than $200 per month. It’s important to note that some Medigap policies are “attained age” policies in which the premiums increase as you age. Others are “issue age” policies in which the premiums are not increased as you get older.

Medicare deductibles and co-pays

These are not insignificant. For 2016, these costs look something like this:

- For Part A: (inpatient hospital, skilled nursing facility, and home health care), Medicare pays all covered costs except the Medicare Part A deductible (2016 = $1288) during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days. For each benefit period, you will pay $1,288 for a hospital stay of 1-60 days, $322 per day for days 61-90 of a hospital stay, and $644 per day for days 91-150 of a hospital stay (Lifetime Reserve Days), and all costs for each day beyond 150 days.

- For Part B: (physician services, outpatient hospital services, certain home health services, and durable medical equipment): You pay $166.00 per year deductible and 20% of the Medicare-approved amounts for services after you meet the deductible.

Dental, vision, and hearing care

These categories are generally not even covered by Medicare and may be 100% out of your pocket. However, some of these costs can be covered to some extent by a Medigap policy.

My cost estimate

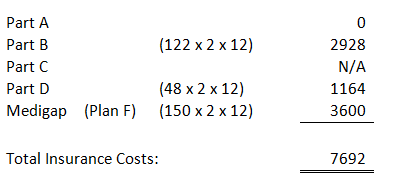

I have computed an estimate of what Medicare and Medigap services would cost if my wife and I enrolled today. But before I get to that, I need to emphasize that these are estimates only and these costs can change yearly. There is also reasonable concern about our government’s ability to pay for these programs at their current price points, especially over the next ten years when all us Baby Boomers reach 65. Whatever you estimate your costs to be, it may be wise to assume that they are only going to increase in the future, perhaps dramatically.

Here’s a rough estimate of what our costs would be on an annualized basis for my wife and I (mainly medical insurance costs involving Medicare Parts A, B, C and D and associated Programs). I did not price the Medicare Advantage – Part C, which would replace Parts A, B, and D if we opted for it. The annual costs would be as follows:The cost is very close to what I currently spend for my employer-sponsored health plan, which includes dental and vision insurance. However, my current plan has a fairly large deductible which may be a little better with my Medigap Plan F. It is MUCH lower than an Obamacare “Silver” Plan that I looked at a few years ago – it would have been around $19,200/year with no subsidy. If we choose a lower cost Medigap plan (with lower coverage and higher deductibles), our premium costs could be reduced.

It is important to note that the amounts listed above do NOT include any annual deductible, co-pays, and other out-of-pocket expenses. But I incur them now with my current plan and include some allowance for them in my budget. If they are major (i.e., have to pay the deductible all at once), we would have to dip into our emergency fund for that.

What will it cost you?

Your Medicare costs may be very close to what I estimated above, depending on what kind of plans you select for Parts D and for Medigap insurance. I used middle-of-the-road numbers for my estimates, so yours could be higher or lower.

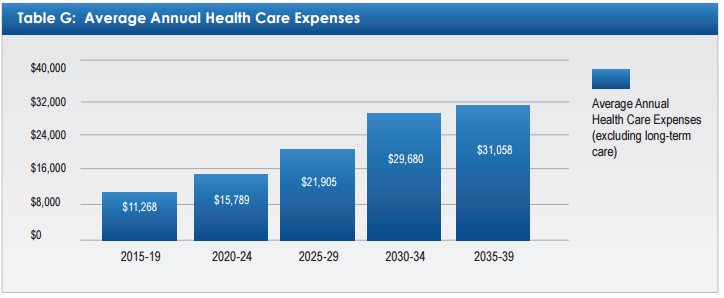

One thing is for sure: health insurance and care is going to a significant expense in retirement so you need to plan accordingly. The chart below from Healthview shows a 65-year-old couple’s estimated average annual health care expenses for five-year periods in retirement. Amounts are expressed in future (inflation-adjusted) dollars.

Some amount of retirement savings and/or the income it generates will be needed to help fund your health care expenses. According to a report by the Employee Benefit Research Institute, a 65-year-old male retiree needs $68,000 in savings to have a 50% probability of being able to cover retirement health care premiums and out-of-pocket expenses. From women, the number is $89,000 (due to longer life expectancy). If either wants a 90 percent chance of having enough savings instead, $124,000 is needed for a man and $140,000 is needed for a woman.

Looking at it differently, according to HealthView, a relatively healthy 65-year-old couple can expect to spend $266,600 over the course of their retirement on Medicare premiums alone. Another study by Fidelity in 2015 has it a little less at $245,000 (see chart below). Neither includes out-of-pocket expenses or long-term care costs, which could take it much higher.

How to plan

First and foremost, you need to educate yourself to make sure you understand your options and key dates and deadlines. You should also seek professional assistance, including a phone call or face-to-face meeting a Medicare specialist, if necessary.

Beyond that, the most important thing you can do is SAVE. A good chunk of your retirement savings will be needed to pay the Medicare premiums and also to fund deductibles, co-insurance, and out-of-pocket expenses. The smaller your savings, the more you will have to rely on other income sources (Social Security, pensions, annuities, etc.). Medicare premiums are deducted from your Social Security check. For those with smaller Social Security payments, it can take a sizable chunk.

A great way to save is with a Health Savings Account (HSA). You can qualify for an HSA if you are enrolled in a high-deductible health insurance plan as so defined by the IRS. It is a great way to save for health care expenses and reduce your taxable income at the same time. Currently, you can contribute $3,350 for an individual or $6,650 for a family. After age 55, you can make an additional contribution of $1,000 each year. Once you have Medicare, you can no longer contribute to your HSA, but you can use the money tax-free to pay for medical expenses not covered by Medicare.

Plan to include your Medicare insurance premiums in your monthly budget as essential expenses, just as you do for your current health insurance premiums. Some may find that their insurance expenses are actually less under Medicare, but overall expenses may be higher due to out-of-pocket costs and higher medical costs in general.

You will also need to plan for deductibles, coinsurance, and other out of pocket expenses – the things that are not covered by Medicare. This is the great unknown. One way to do this is to set aside some money for that purpose in a “sinking fund” each month or add it to your emergency fund so it’s there when you need it. The safest approach would be to assume that you will pay the maximum deductibles and other payments each year. If you don’t need it, then you can just carry it over to the next or use it for other purposes.

Consider getting supplemental coverage. Medicare Advantage and Medigap plans cover many of traditional Medicare’s out-of-pocket costs and will sometimes cover additional services in exchange for a monthly premium. If you can’t afford the premium, see if a lower cost plan will meet your needs.

Avoid the late sign-up penalties. If you don’t sign up for the various parts of Medicare on time, you could be charged higher premiums. Your initial sign up period for Part B is a seven-month window that begins three months before you turn 65. After that, your Part B premiums will increase by 10 percent for each 12-month period of delay.

Also, if you stay employed after age 65 and are covered by an employer group health plan you will need to sign up within eight months of leaving the job or the health plan to avoid the late enrollment penalty. You could also get hit with a Medicare Part D late-enrollment penalty if you go 63 or more days in a row without prescription drug coverage after you qualify for Medicare.

And last but not least, there’s a six-month window beginning the month you turn 65 when you have a guaranteed right to buy any Medigap policy, after which you could be charged higher premiums or denied coverage.

Doing these things will make your health care expense challenges more manageable, but are not a substitute for faith and trust in God. Do all you can and trust him for the rest.