On this blog, I provide a checklist of things you can do during different stages of life to “retire with dignity.” In this article – the first in a series of four with each focused on a different stage of life – I will discuss the most important thing you can do when you’re in your 20s and 30s.

In the second article, I’ll discuss the most important thing to do in your 30s and 40s; in the third, I’ll focus on the 40s and 50s; and finally, I’ll discuss what retirees in their 60s and beyond need to do.

Admittedly, there are a lot of important things you need to do to make sure you can retire with dignity. What I want to do in these articles is to encourage you to get focused on the things that will have the greatest impact later on.

If you’re reading this and you’re older, send this to your son or daughter, or perhaps a friend who could benefit from it!

As I describe in the checklist for those in this phase of life, if you are in your 20s and 30s, you need to be thinking about things like finding work you enjoy, setting up a budget, avoiding most debt, and starting to save, among others.

Some would probably say that finding and keeping a job is the most important thing, and I understand that. But let’s take that as a “given” – sometime in the years after you leave college you are going to find viable employment. Once you do that, what is the most important thing you need to do to retire with dignity?

Drumroll, please… Start saving! Yep, that’s it. Sounds simple, but the thing that can help you the most also happens to be one of the hardest during this stage of life.

What’s the big deal?

You’ve heard it before: “Save as much as you can now for retirement because Americans are living longer than ever and your chances of running out of money are greater than ever.” If you’re in your 20s or 30s, you’re probably thinking, “yea, yea., those older folks need to get their act together.” Well, please listen up: This isn’t just a catchy phrase, it’s a plea to everyone to save enough so that they can retire with dignity. The younger you are, the greater your opportunity to get this right. You only have one shot at it!

Consider these startling statistics from the Employee Benefit Research Institute:

- The average 50-year-old has $42,797 saved.

- Nearly a third of Americans age 55 and older have saved less than $10,000 for retirement. Only 22% have saved $250,000 or more.

- The average net worth (assets minus debts) of a 55 to 64-year-old is $45,447.

- 45% of Americans have saved nothing for retirement, including 40% of Baby Boomers.

- 38% don’t actively save for retirement at all.

- 20% of Americans tap into their 401(k) assets early, either through a loan or withdrawal.

- 80% of Americans between the ages of 30 and 54 believe they will not have enough saved for retirement.

According to the 2016 JP Morgan Asset Management: Guide to Retirement, which I will reference several times in this series (I’m not promoting JPM Asset Management, but they are a reputable firm, and I like this report that they put out each year), a 35-year-old making $ 75,000 annually should have $90,000 saved for retirement. That implies that a 35-year-old has been saving something since their mid-20s. Compare that to the data points listed above, and you’ll see that these concerns are well founded.

Some have labeled this disparity one of the great financial and social issues of our time.

Whatever the exact extent of the “crisis,” it will take a concerted effort by individuals, employers, financial institutions, and the government to address it. In this article, I will hopefully convince you that saving something is the most important thing you can do when you’re young to improve your retirement readiness.

Why this is the most important thing in your 20s and 30s

You’re out of college and in your first or second job. You’re making more money than ever, but it never seems to be enough. You even may have bought you first condo or house, but you’re more likely to be paying high rent to live closer to work. You enjoy eating out, going to movies, and taking an occasional road trip.

Perhaps you’re married and have a child. If so, you’re dealing with another set of expenses. You likely have student loans to pay as well as a car loan and credit cards.

In other words, lots of life without lots of money. Your focus is on the here and now – you have bills to pay and things to do. Sound about right?

According to Forbes magazine, one reason why we don’t save for retirement is that, for many, the future isn’t real – the only thing that matters is the here and now. Forbes cites some of the main reasons as pressing immediate needs, a desire for instant gratification at the expense of the future, and the certainty of “now” versus “then.” In short, we have great difficulty imagining our retired “future selves” (called “cognitive shortsightedness”).

Let’s say you’re 30 years old and earning $ 50,000 annually. I know it’s hard but imagine for a moment that you are your “future self.” You’re 70 years old (think about your grandpa if you need to) and retired.

If you need more help, I think there’s an app called AgingBooth that you can use that actually ages you on your screen so you can visualize your “older self”. Use it at your own risk; I think it’s kinda creepy.

Based on average annual inflation of 3%, you need an annual income of $98,490 to replace 70% of your pre-retirement income. Social Security is virtually non-existent except for the neediest retirees. You don’t have a pension – they became obsolete several decades ago. Due to healthcare advances, your average life expectancy is now almost 100 years old. And you need enough money to live another 20 or 30 years, perhaps longer.

Now, you’re back to your “current self.” Based on what you now know about your “future self,” what is the most important thing you can do at this point in your life? It’s simple: start saving – the sooner, the better! The sooner you take advantage of the “magic” of compound interest, the better. (More on that later in the article.)

Just do it

If your employer offers a 401(k) or 403(b) type retirement savings plan, sign up for it! If it doesn’t, or if you’re self-employed, you can open your own Traditional or Roth IRA. (If you’re a business owner, you will want to consult your tax professional.)

Sadly, there is research which shows that less than half of us participate in such employer-sponsored retirement plans. Since most employers offer some savings match, a lot of people are passing on FREE MONEY! If your employer matches your contributions dollar for dollar up to a certain percentage of income, that is an instant 100% return! If they match up to 6% of your income, you are effectively saving 12% a year including the employer match. (You can do the math for your own individual situation.)

Saving early in your career is probably the most powerful thing you can do to make sure your “future self” can retire with dignity.

It’s also important to do it automatically on an ongoing basis – set on “auto-pilot.” You can use payroll deductions (to an employer-sponsored plan) or electronic funds transfer (from your checking account to your IRA) to make this happen.

Optimally, you will save between 10 and 15% (including the employer match). If you start out saving less, you may have to ramp up significantly when you are older.

The “eighth wonder of the world”

The reason it so important to start early is to take advantage of the “compounding effect.” Albert Einstein put it this way:

Compound interest is the eighth wonder of the world. He who understands it earns it … he who doesn’t … pays it.

The power is in the fact that when you earn interest on savings, that interest then earns interest on itself and is compounded monthly, year after year. The earlier you start, the longer it has to compound, and the results can be quite amazing.

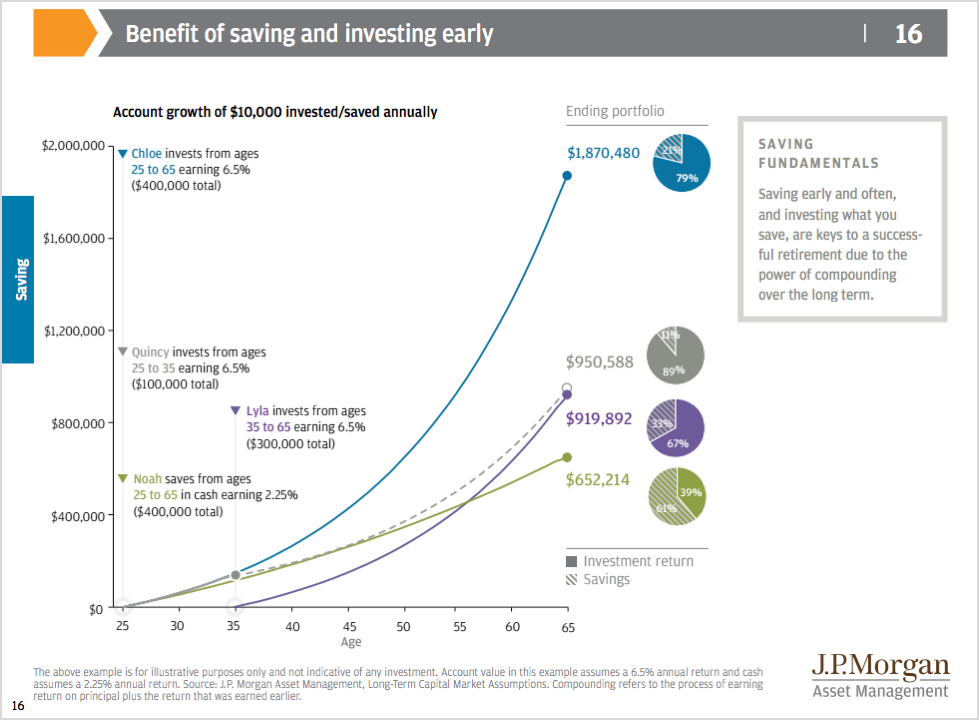

Look at the examples shown in the chart below from the JPM 2016 Retirement Guide:

In this example, Quincey saves and invests $10,000 a year from age 25 to age 35, for a total of $100,000, and then stops. He will have over $950,000 by age 65.

Lyla, who waits until age 35 to start saving and saves until age 65, a total of $300,000, will have about $920,000. She saved more than Quincey, who didn’t save at all past age 35, but will retire with less.

Then there’s Chloe who starts ten years earlier than Lyla and saves $400,000 from age 25 to age 65. She will have an astounding $1.870 million, about double what Quincey and Lyla will have – just because she started ten years earlier!

Noah comes out on the short end of the stick as, although he starts early and saves $400,000 until age 65, the same as Chloe, he invests mainly in “cash” and does not get the returns enjoyed by the other three. He ends up with only $652,214, about a third of what Chloe does.

The financial markets (stocks and bonds) carry some risk, but inflation will devalue your savings if you keep them all in cash, which is even riskier.

Slow and steady wins

The lesson here is clear: The earlier you save – even if it’s a relatively small amount – the more time you have for compound interest to work its wonders. Even if things go south from time to time (and they inevitably will), the good and sometimes great times will help smooth things out, and you’ll almost always be better off than sitting idly in cash year after year.

Once you get on your feet after college, get out of debt, set aside an emergency fund, and then start saving for retirement. Live below your means and use a budget so that you can give yourself the financial margin you need to be able to save and give. Starting with just $50 or $100 a month in your 20s will pay off big by the time you are in your 60s. And don’t overdo it. We’re talking about saving, not hoarding. Slow and steady wins the race!