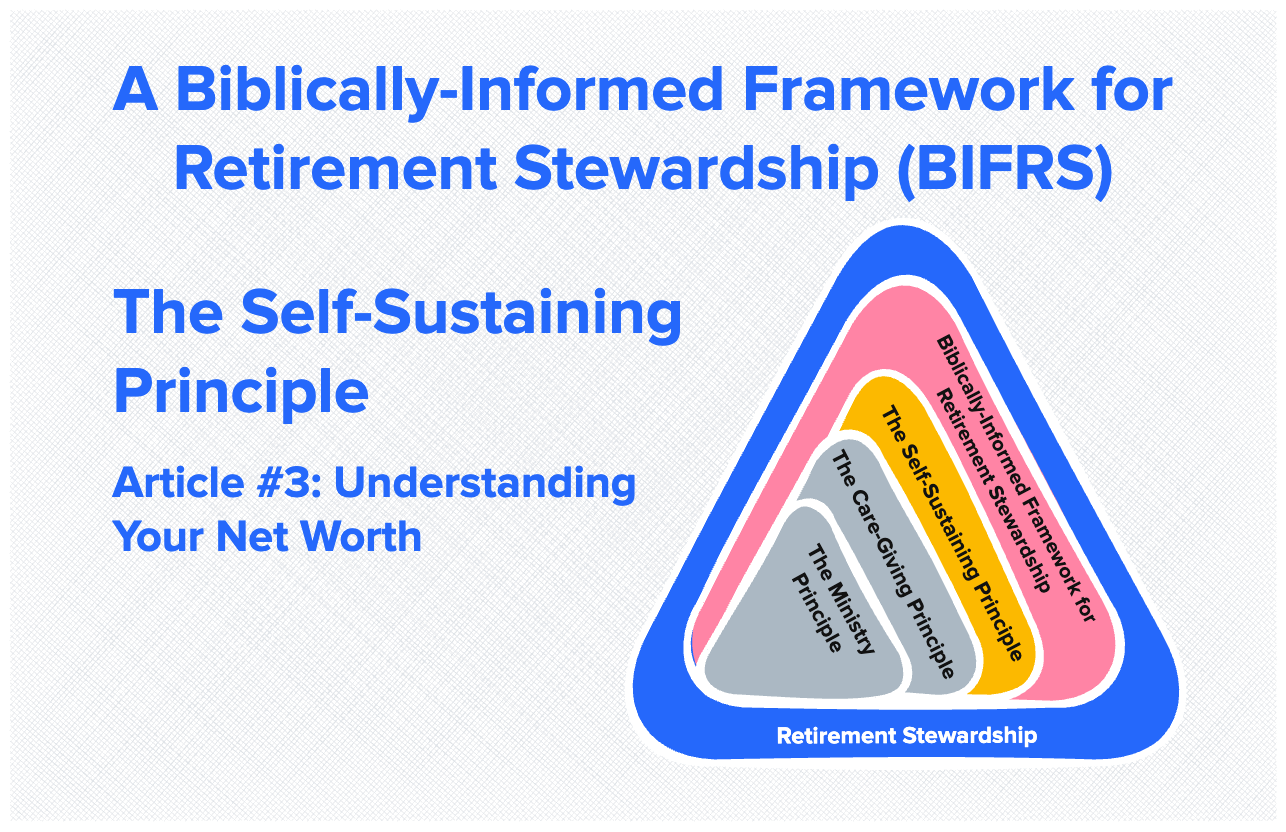

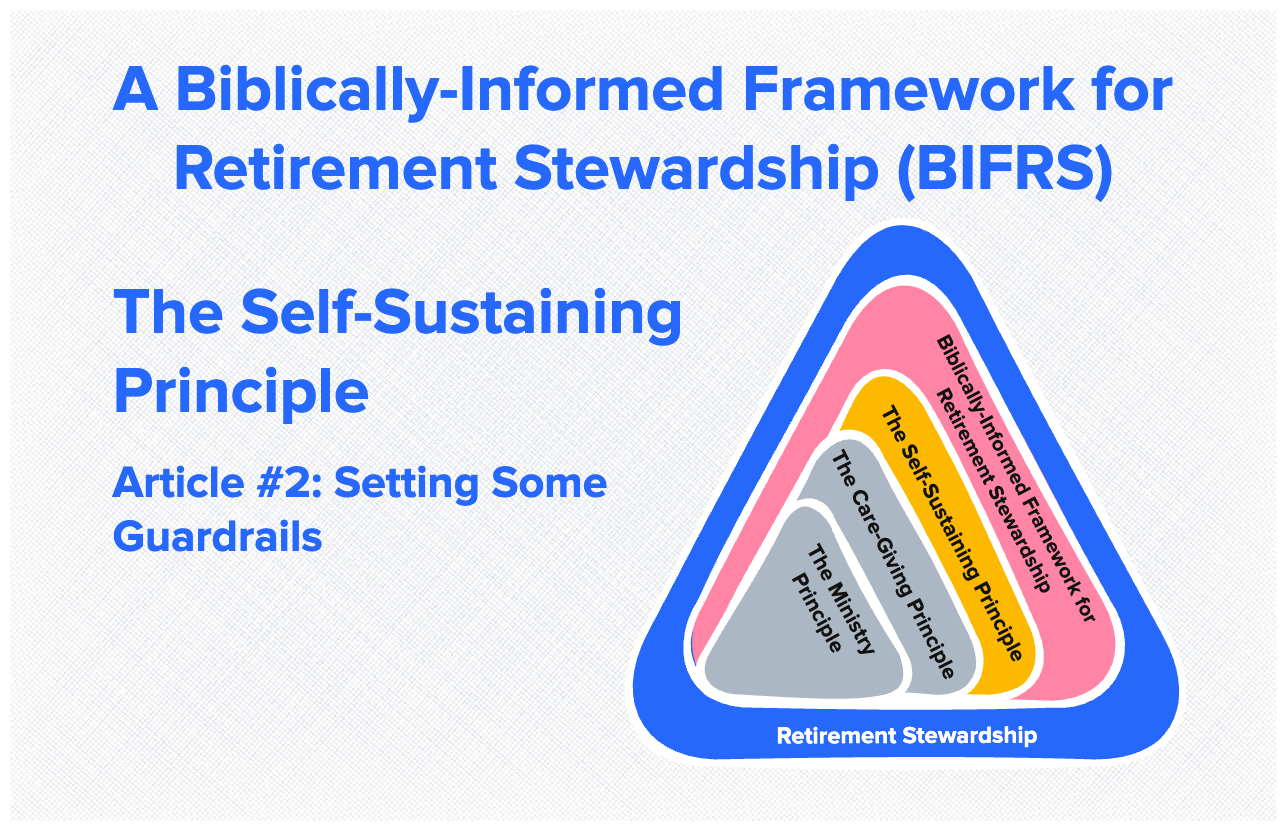

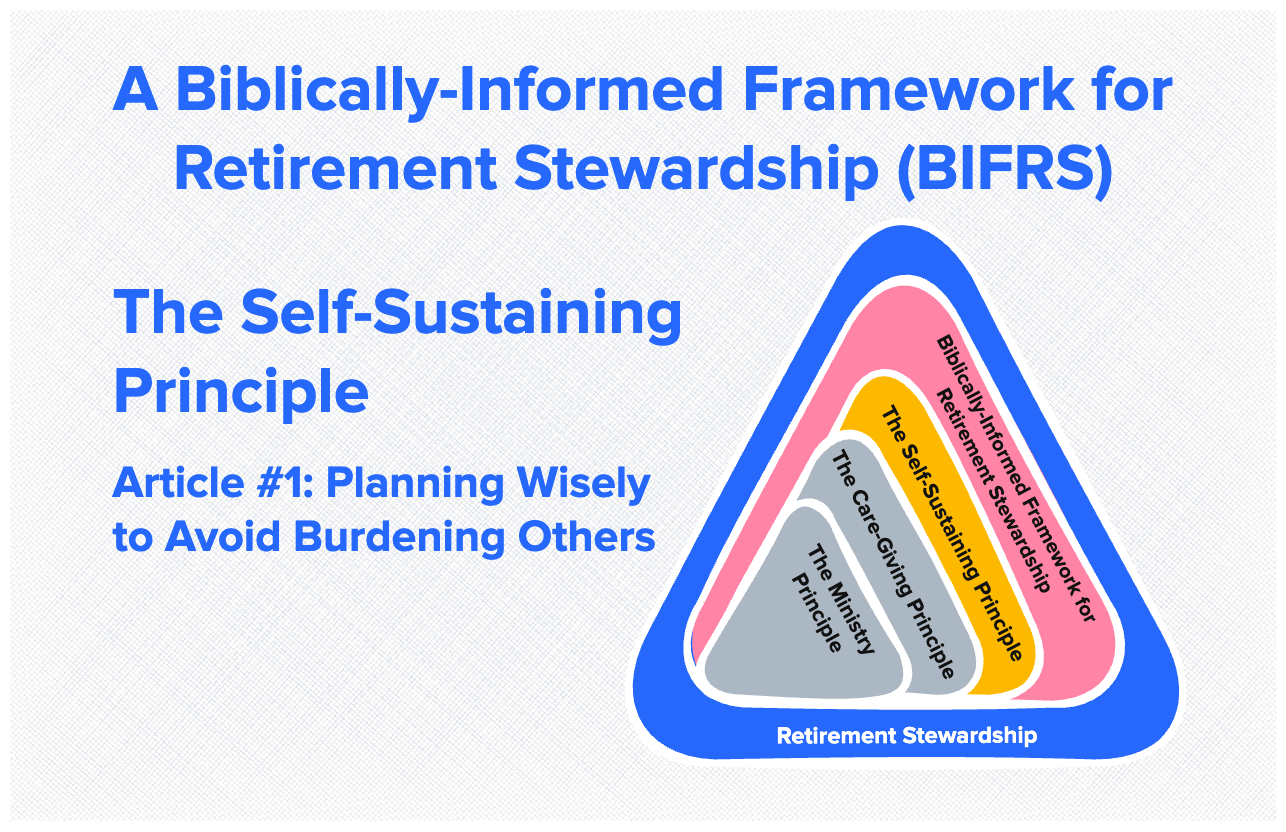

The Sustainability Principle—Article #3: Understanding Your Net Worth

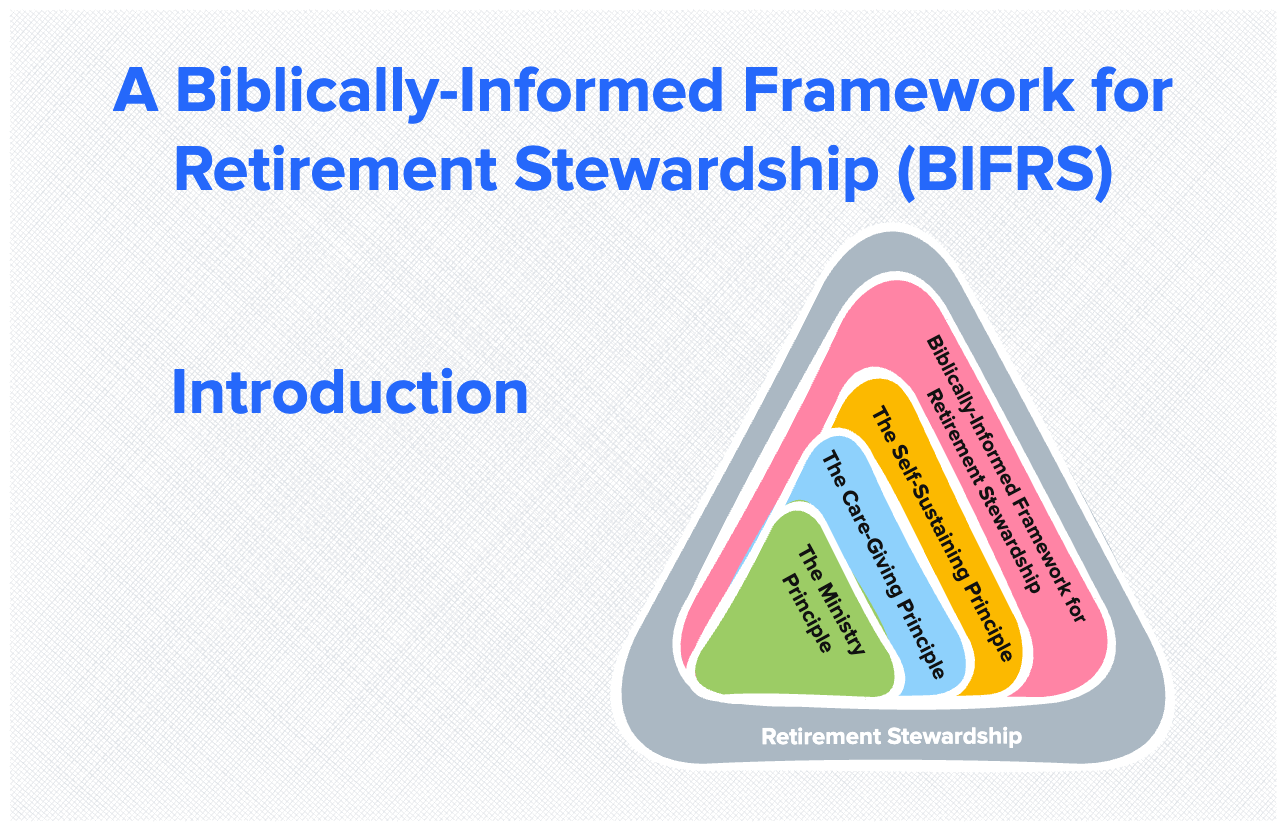

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series. In the first two articles in this series, I introduced the Sustainability Principle—the fundamental concept that your retirement will be financially sustainable when your reliable income sources consistently cover your ongoing expenses and obligations throughout your lifetime. We also discussed this from … Read more