A friend’s wife texted me a while back asking about “Paze.” I hadn’t heard of it then, even though, as I’ll explain later, I practically “invented” it many years ago—well, not really, but kinda-sorta (well, you’ll see).

It sounded like another digital payment product, so I looked into it. (I used to work in IT in banking, so you’d think I would know about such things, but alas, I didn’t.)

Sure enough, Paze is a (relatively) new online payment service. But unlike most of the others you’ve probably heard of—PayPal, Venmo, Apple Pay, etc.—this one was developed by a group of major banks, including Bank of America, Capital One, and Wells Fargo. (My friend banks with BofA, and they had invited her and her husband to sign up for Paze.)

Naturally, her question, in so many words, was: “Should I sign up and use this?” It’s a good question, and maybe you’ve wondered the same thing about Paze or other digital payment systems and apps. That’s what we want to discuss in this article.

Digital payments are now the norm

Whether you realize it or not, digital payments are quickly becoming the standard way to buy things and send money. According to ecommercetips.com, as of 2025:

“Two-thirds of adults worldwide are now using digital payments—89% in the U.S. Digital wallets account for 49% of global e-commerce sales, while credit cards account for just 21%. The top digital wallets in the U.S. are PayPal (36%), Apple Pay (20%), and Venmo (16%).”

In other words, digital payment platforms aren’t just trendy; they’re mainstream. They’re used for person-to-person transfers (like splitting a lunch tab) and online and in-store purchases. (By the way, full disclosure: I use all three “digital wallets” cited by Ecommercetips.

Before returning to Paze, let’s examine how some better-known systems—PayPal, Venmo, and Zelle—work.

How digital payment apps work

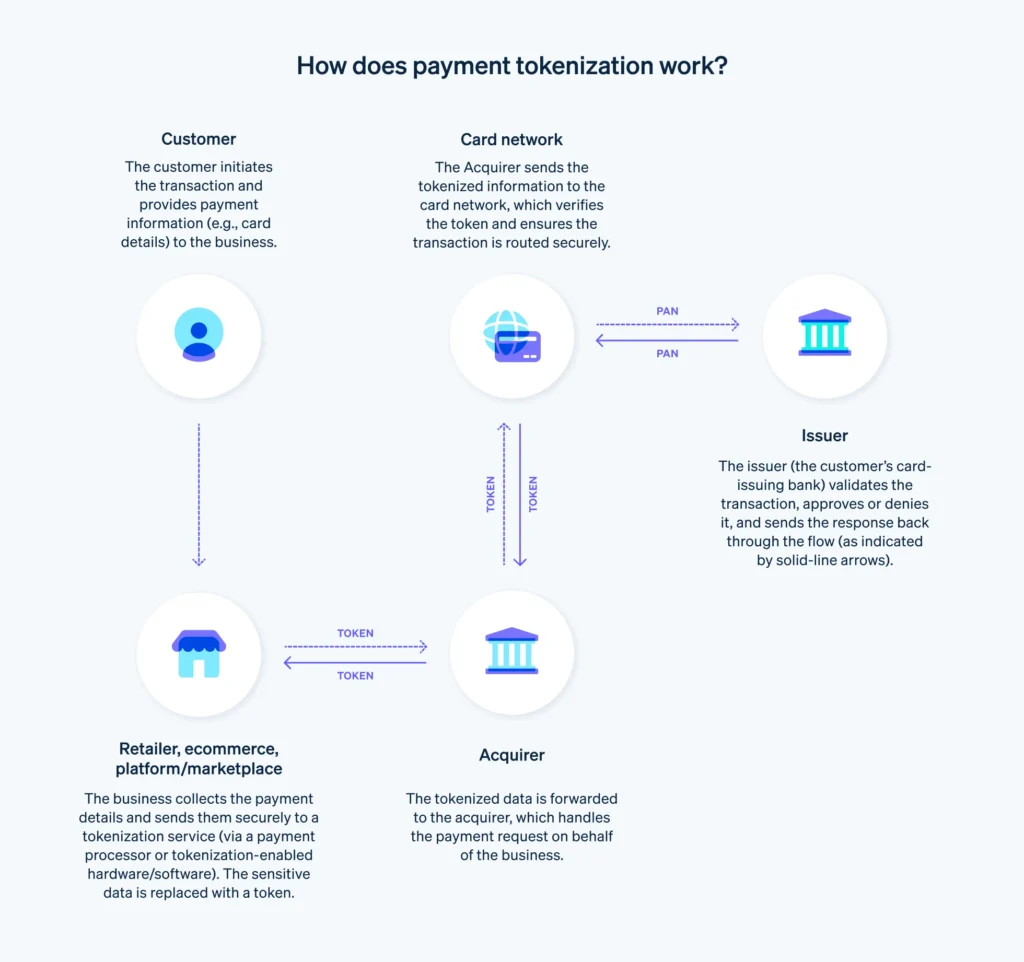

These platforms let you send or receive money using your phone, computer, or tablet. Take a look at this high-level payment process flow diagram:

When a user initiates a payment using some system or app, the platform verifies their identity and authorizes the transaction through secure encryption technology. The money is transferred directly between users (Venmo or PayPal’s peer-to-peer feature) or processed at a point of sale (as with Apple Pay), often without entering card information for each transaction.

Behind the scenes, the system communicates with banks or card networks to move funds, similar to how traditional credit or debit transactions are processed.

These platforms often hold a balance in a digital wallet, allowing users to store funds and use them for future payments. They also incorporate security measures like biometric authentication, tokenization (which replaces card details with secure, one-time-use codes), and fraud monitoring to protect users.

When you think about it, that’s pretty amazing because most of us remember when the only way to “send a payment” was with a check (or something like it) and a stamp. I even remember putting cash in envelopes and mailing it; what was I thinking?! Then there were money orders, cashiers’ checks, etc., but all paper, in envelopes, in the mail. It was a different time, for sure.

These digital payment systems link to your bank account or card, verify your identity, and allow you to make payments without entering card numbers every time. Here’s a somewhat simplified breakdown of each:

PayPal

This is probably the most familiar name, especially for online shopping and sending money to individuals. My wife and I have used it for years; perhaps you have. PayPal can be used through a browser or mobile app and allows you to link your bank account or credit card, send/receive money using someone’s email or phone number, and make purchases without revealing your card or bank info—amazing stuff (at least compared to sending a check or cash in the mail!).

PayPal also offers strong buyer protection, which adds peace of mind, especially for online purchases. That’s why it’s so popular.

Venmo

Venmo is the “cool app.” (There are others, like “Cash App,” which is also pretty cool—and I confess, I have that one too—but I can’t cover them all.) PayPal owns it, but it’s geared more toward person-to-person payments. It’s become popular, particularly with younger generations, thanks to its simple interface and built-in social features (like sharing your payments with friends, which I personally don’t find all that necessary—you can turn it off if you want to).

Venmo links to your bank account or debit card and lets you send money quickly, often with no fees. You can even hold a balance in the app. Why would anyone do that? I do not know—you’re giving Venmo (i.e., PayPal) a free loan if you do. I guess there is a convenience factor, especially if your bank account is empty and you need to pay.

Zelle

Zelle takes a different approach. It’s built directly into many bank apps, which makes it incredibly convenient. No separate app is required. When you want to send money to someone, it is transferred directly between banks, often in seconds.

Zelle doesn’t hold a balance or offer social features, so it’s not a digital wallet (that’s where Paze comes in). It’s all about the simplicity and speed of person-to-person payments. You may already use it because it’s part of your online banking app.

An aside: I discuss below my dubious claim that I kind of "invented" Paze when working for a large regional bank. (Well, not really, but you'll see what I mean.) I once worked with a woman in an architecture and strategy group who went on to work for Early Warning (EW), a fintech company owned by seven of the largest U.S. banks, where she led the launch of the Zelle Network payment service. In other words, she (and her team) created Zelle, a very popular and successful payments system. Paze was actually developed by EW in conjunciton with a group of large banks.

So, what’s the big deal with Paze?

Paze is the latest entry into this space, but banks are fighting back this time. Rather than relying on Fintech companies like PayPal or Apple, some of the largest U.S. banks have offered their own digital wallets. Good for them, right?!

Here’s how it works: First, there’s no new app to install. If your bank participates, Paze may already be part of your online banking service. Next, when shopping online with a participating retailer, you choose Paze, enter your email, get a one-time passcode to your phone, pick a saved card, and that’s it. You can now make online purchases without sharing your actual credit or debit card numbers with merchants.

When shopping online, you select Paze as your payment method and are prompted to enter the email address associated with your bank account. Once your identity is verified, Paze displays your eligible credit and debit cards from participating financial institutions. You choose the card you’d like to use for the transaction and complete it.

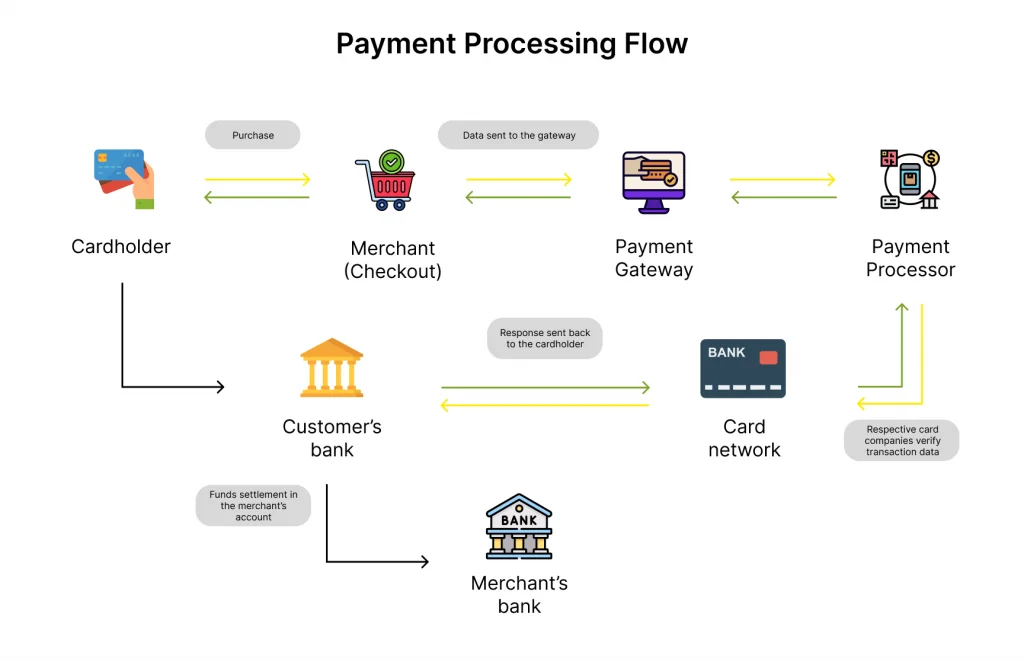

Next is where the cool stuff happens. Paze enhances security by replacing your actual card number with a unique identifier or “token” during transactions. This means your real card number isn’t shared with merchants, reducing the risk of your sensitive information being compromised. Plus, if your card is lost or replaced, Paze automatically updates your card information through your bank, eliminating the need to update details for online merchants manually.

If you’re already banking with an institution that supports Paze, you may not even need to sign up—it might already be activated with your existing card information. How nice (he said sarcastically).

I kinda-sorta “invented it”

Here’s an interesting aside, and yes, it’s true.

In the late 1990s, I worked for First Union National Bank (FUNB), which became Wachovia, now Wells Fargo (through many other mergers and acquisitions as well). I worked in IT then (network planning) but took a new position as Director of Business Operations for a new e-commerce unit in the consumer banking side of the business. It was called the “Remote Access Division” (RAD) or something like that.

It was the only “business” role in my career in banking, but it was really more of a hybrid—the focus was on IT and operations of our website, but I had some idea of what I was doing (although some may have disagreed). Corporate websites and online banking via “legacy” back-end systems were pretty new at the time, so it was challenging to say the least. We were just coming out of the “you’ve got mail” era.

This new eCommerce unit was tasked with bringing firstunion.com in-house (the website was outsourced at the time, which was common in those days). I was responsible for day-to-day operations, quality service levels, analytics, and performance, and the development and maintenance of web “front end,” mostly HTML and Perl scripts for secure online forms (CGIs for you computer nerds out there) in those days. (Remember the “webmasters”—we had a room full of them. I sometimes even talked to customers to help resolve computer and web browser compatibility problems (fun, fun).

Our big goal was to build a new web front-end and connect it to our “back end” banking systems and transactional databases, which ran on large, high-performance IBM mainframes, applications, and databases. This was difficult as the integration software (a/k/a “middleware“) was nascent and challenging to implement. Privacy and security were significant concerns, too. Plus, we were building a lot in-house while also using outside providers.

It was an exciting time; we felt we were the bank’s future. In some ways, we were. Who out there doesn’t use online bill pay? (Only a few of you, I bet.) The bank’s Chairman and CEO once visited us for a pep talk during a staff meeting. It was important work, but there’s much more to banking than online bill pay. One of the things that the company asked for was ideas for new product or service innovations from the staff. Well, one day, I wrote one up and turned it in.

I wish I had a copy of it. After a lengthy discussion with my team and some folks from the bank’s “Card Products” division about customer concerns about online fraud (internet security was also a very immature discipline at the time, with few technology solutions available other than “HTTPS//” and secure account sign-on codes), I came up with an idea: What if, instead of asking customers to use their FUNB credit card number, we issued them a “temporary” number to use for the online transaction that was linked to their real account? They could use that number; their account number would be kept private, and the issued number would expire. If someone intercepted and tried to use it, they’d be unsuccessful.

I submitted the idea in writing, but never heard back. That was more than 25 years ago. Well, decent ideas finally come to something, I guess—my concept is very similar to Paze’s, which does it with much more sophistication and stronger security. Instead of a transient card number for one-time use that you would manually enter, it uses a security “token” automatically embedded in the transaction data. Payment processor Stripe describes “tokenization” as,

A unique, random set of characters [used to help] help keep payment data safe during transactions, because the actual card information is not being used or stored. If someone were to access the token, they wouldn’t be able to use it to make fraudulent purchases since it doesn’t contain the real payment details. By using tokens instead of actual card information, businesses can provide a secure and seamless payment experience for their customers while reducing the risk of data breaches and fraud.

Again, for you nerdy folks out there, here’s a diagram of the tokenization process, also from Stripe:

Doesn’t that all sound like my suggestion from 25 years ago? Maybe I was on to something after all (even though I had absolutely no idea how it could actually be done). I won’t lose sleep waiting for my royalties from Wells Fargo and the other banks to roll in.

Why banks created it

Let’s be frank: Paze isn’t just about helping consumers shop more securely online. Banks want to keep your transactions within their ecosystem rather than losing business to third-party apps. By offering a convenient, secure alternative, they hope to make their services “stickier” and thus more challenging to leave. And, of course, they’ll earn more revenue in the process.

Still, if it’s easy to use, integrated into your current bank, and offers stronger security, it could be a win-win.

Are these apps safe?

That’s the million-dollar question that everyone asks. It’s a reasonable one, especially when protecting your finances in retirement.

Most major platforms (including PayPal, Venmo, Zelle, and now Paze) use encryption, fraud monitoring, and other security technologies. However, scams are still a concern, particularly peer-to-peer scams, in which someone tricks you into sending money and then disappears. (If you haven’t picked up on this, I despise how fraudsters and scammers target older people.)

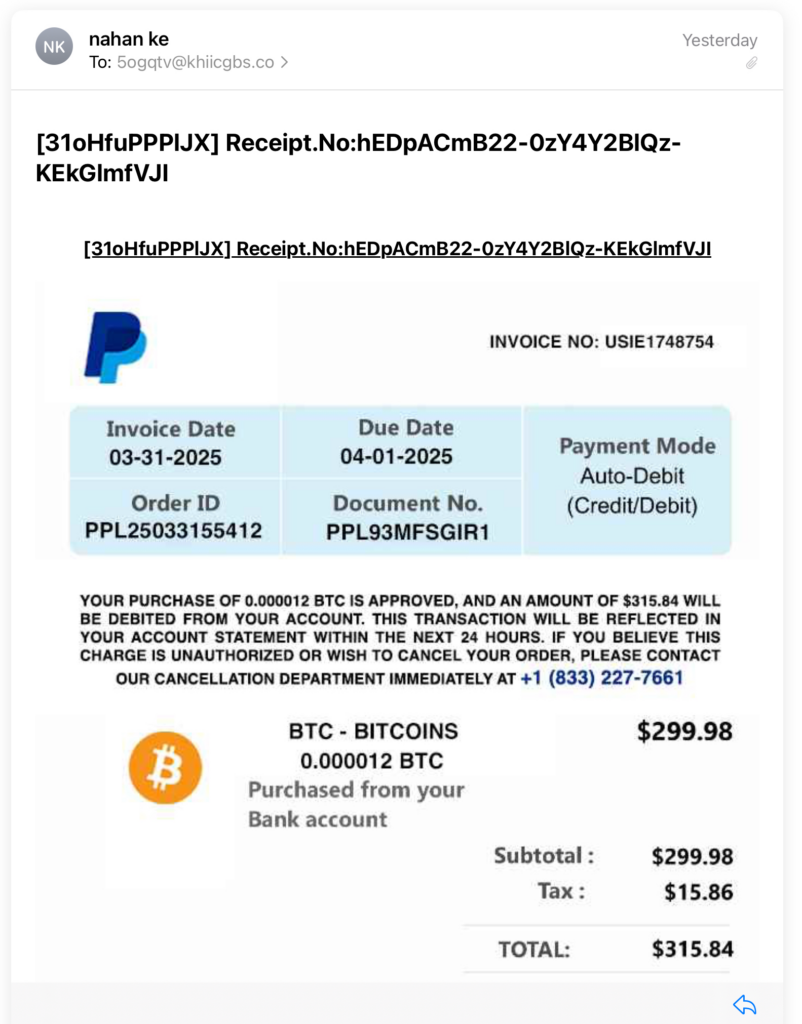

Another type of scam, text, and email phishing, is also prevalent, especially with PayPal, since it is used widely. Just today, as I was working on this, my wife received this text message:

You can use PayPal to buy Bitcoin on several platforms (such as Coinbase), and this is an example of a PayPal phishing attempt using a made-up transaction to make you think your PayPal account has been compromised. My wife didn’t buy .000012 shares of BTC (Bitcoin). “Hey honey, how’s your Crypto doing?” Right.

Don’t you love that they included the Bitcoin icon? So convincing. But, as you can see, the notification looks pretty authentic until you look closer. First, notice the “from” name and “to address”: nhan ke (KE), sent to 5ogqtv@khilcgbs.co. That’s not my wife’s email; it’s probably not anyone’s. Then there’s the ridiculously long and complex receipt number with some strange prefixes. Finally, a lot of the language, like “invoice,” “account statement,” “purchased from your bank account,” and the offer of an “instant refund” (since you didn’t make this purchase), are giveaways.

Some security experts suggest that if you use apps like PayPal or Venmo, link them to a separate checking account, not your main one. I do a version of that. Most of my assets are in my Fidelity IRA, but I keep just enough in a separate Fidelity bank account to handle bill payments. If someone accessed that account, they couldn’t “wipe me out.” I use a 2 percent cash-back credit card as much as possible, so I don’t have to have that money just sitting in a checking account. That way, if something goes wrong, the damage is limited. (Many online banks now offer no-fee checking accounts, and Fidelity is one of them, which is perfect for this.)

Here’s a quick overview of each app’s security posture:

- PayPal: Excellent buyer protection, secure payments, and transaction monitoring.

- Venmo: Good security features like PINs and multi-factor authentication—but weaker on refunds for scams.

- Zelle: Fast, bank-level security, but no buyer protection. If you send money to the wrong person, it’s likely gone for good.

- Paze: This app uses tokenization to protect your card information, which is managed within your bank’s secure environment. There is no new app or password to manage.

What if you’d rather stick with good old-fashioned banking?

I can’t blame you, especially given all the identity theft and fraud we hear about. Not everyone is comfortable with mobile payment apps, and that’s perfectly fine.

You can still use checks, which are reliable and traceable, especially for bills and donations. But they can be defaced, forged, and stolen, especially from the mail. Cash is still best for in-person transactions but is not as traceable as a check.

Traditional bank transfers are easily handled through your online banking service or in person at your branch.

Finally, there are debit and credit cards. With strong fraud protection and easy dispute processes, cards remain among the safest payment methods.

I don’t use Paze, even though I “invented” it

My “bank” (Fidelity) doesn’t offer it, so I don’t use it. (If it did, I probably would.) However, I do use PayPal, Venmo, and Apple Pay with my Fidelity accounts, and they’ve worked well for me. I appreciate the flexibility and don’t mind using a third-party platform if it’s secure and convenient.

If your bank already offers Paze, and you’re happy sticking with them, it might make sense to try it. But you’re under no obligation. It’s just another tool that may streamline online payments and enhance security.

Stewardship matters in all things financial. Be wise. Do your homework. Use tools that help you manage your money faithfully and securely—whether it’s Paze, PayPal, or just your trusty old checkbook. Even cash in an envelope works if you’re willing to take a chance (but I wouldn’t advise it).

“Be wise as serpents and gentle as doves.” – Jesus