This is the second article in a three-part series about investing for retirement. In the first article, I discussed the various types of assets you could hold as investments. In this article, I’m going to look at the different ways you can invest in them and different management styles (active versus passive.) The better you understand your options, the wiser your investment decisions will be.

I want to emphasize again that nothing in this article should be taken as financial advice – it is intended to be used for information and education purposes only. Unless you are highly confident about doing it yourself, I would strongly urge you to consult with a fee-only professional investment advisor who acts in a fiduciary role before making any major investment decisions.

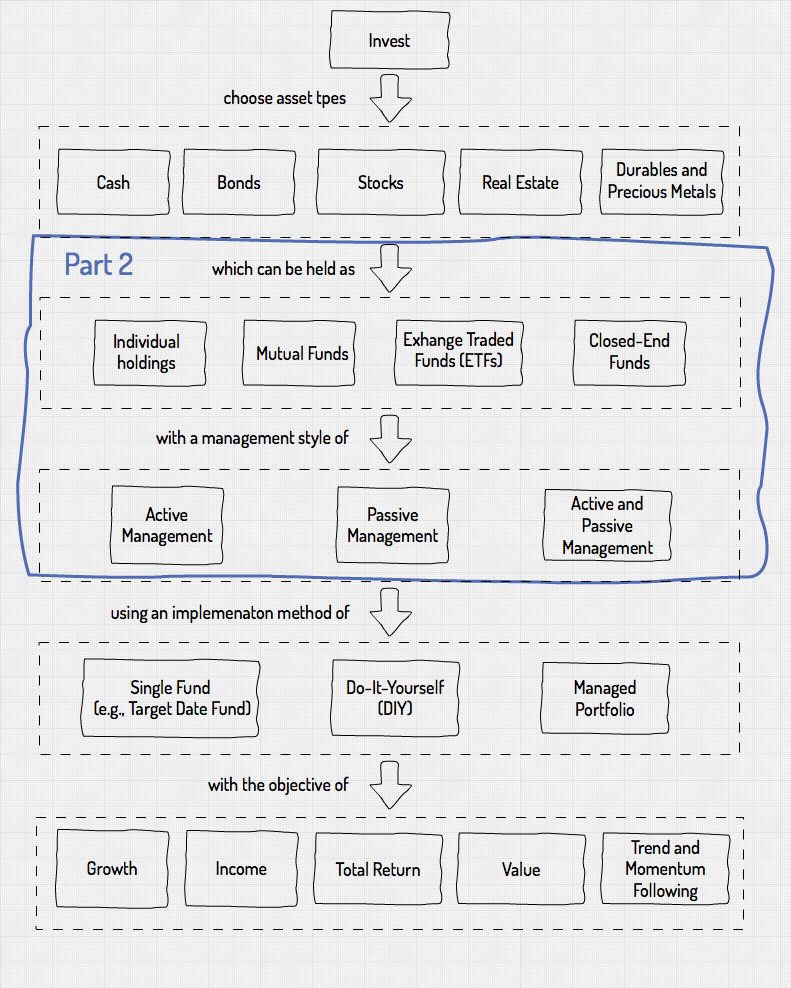

We are still working through the investing ‘framework’ I introduced in the first article. The focus of this article is highlighted below:

You have many options when it comes to the kinds of assets you can purchase and how you can own them. In fact, at the end of 2016, there were over 9,500 mutual funds and almost 2,000 ETFs in the U.S. financial marketplace. Most people will own between 5 and 15.

Having such a large number of options is both good and bad: Good, in that, you have so many choices, and you can be very targeted with your investing strategy. According to Forbes, if you want to invest in an “Anti-Terrorist Fund,” you are in luck. There’s even a “Black Box Fund,” but unfortunately you won’t have any idea what its holdings are – it’s a ‘black box,’ after all.

The bad part is that so many choices can cause decision-making to become overwhelming. Plus, many people make their investment portfolio too complex, which makes them difficult to manage effectively. There is no magic number, but most people need fewer than ten mutual funds or ETFs to have a well-balanced portfolio. It’s even possible to do it with a few as two or three, and some people only hold one (typically something like a Vanguard LifeStrategy Fund or a Fidelity Target Date Fund). This can be an optimal approach for many people.

Asset holding alternatives

Most of the asset types discussed in Part One can be bought and sold as individual holdings and held in various kinds of bank and brokerage accounts. You can also purchase them along with other investors as part of a basket of similar pooled assets. Most are not quite as esoteric as the oddball examples I gave above.

Individual Holdings

Cash deposit accounts (such as checking, savings, CDs, and money market accounts) are considered individual holdings, but financial institutions pool cash assets and use them for specific purposes (lending, investing, etc.). The cash that I hold in my Fidelity IRA is in very low-interest FDIC insured savings account. I do that for safety, not to earn interest.

You are not going to earn a lot from these products, but you might at least be able to keep up with inflation. A 3-year FDIC insured CD currently yields between 2.5 and 2.9 percent. The Fidelity Money Market Fund (SPRXX) has a current yield of 1.68 percent. You are basically accepting low interest for safety.

You can purchase individual stocks and bonds on the various exchanges using a brokerage account. As we shall see later on, you can choose individual stocks with particular objectives in mind, but most people are looking for share price growth (“capital gains”) when they invest for retirement. Income, in the form of stock dividends, is usually secondary. Dividends can be reinvested to purchase additional shares, which is the stock investing version of compound interest.

Online discount brokerages are going to be the lowest cost, whereas trades using a “full service” broker will cost more. No matter what, you almost always have to pay a fee (a commission) each time you buy or sell. I have an IRA in a Fidelity Investments Brokerage account. They charge $4.95 per transaction, as do Charles Schwab and Ally Invest; TD Ameritrade, E-Trade, and Merrill Edge are a little higher at $6.95 per trade. Some brokerages offer volume discounts (i.e., for buying or selling large numbers of shares).

Basic online commission costs are usually not going to be a significant factor unless you are ‘trading’ a lot. However, I make a distinction between trading and investing. Trading is when you buy a stock and then sell it a short time later to pocket a gain due to an increase in value. Some people sell when the stock has lost value so that they can cut their losses.

Investing is when you buy a stock and keep it for an extended period, perhaps for decades. You don’t sell just because it’s up 10 percent one day or down 12 percent the next. You are investing over the long term because you believe the company will remain competitive and profitable, and hopefully continue to grow, over the long haul despite the occasional bumps in the road.

Trading (stock picking, buying, and selling) requires more knowledge, time, and effort and can be riskier than the pooled asset alternatives I will discuss here. For that reason, as wise stewards, we have to be careful about taking undue risks with the Master’s wealth. God expects us to put his money to work, but not necessarily to turn a quick profit (which is just a likely to result in a loss, perhaps more so). We must be on guard against the temptation to get rich quick in the stock market, which is what market bubbles are all about. Plus, such a motivation can drown out the more rational counsel to set aside little by little from our current abundance for a future needs such as retirement (Prov.6:6-8).

I am NOT saying that you should never hold individual assets, nor am I saying that you should never ‘trade’ stocks or bonds. However, I do think we have to be careful of our motives and always ask ourselves, “Is this what the Lord wants me to do with his money?” Although it is not uncommon for people to hold cash, stocks, bonds, and other assets individually as investments, it is more common for individuals to buy ‘pools’ of assets of similar types, and some have both.

Advantages of pooled asset investments

Pooled assets offer some significant advantages over individual holdings. Investopedia lists the major benefits of investing in pooled investments over individual holdings as diversification (invest in a number of different stocks or bonds in a single fund), customization (securities selections targeted at particular investor goals, time horizons, and risk profiles), oversight (day to day monitoring of the markets and initiating buying and selling activities), and affordability (ability to purchase otherwise unaffordable securities).

Another feature of pooled asset investments is that assuming they aren’t brand new, there will be a lot of historical performance data available. This data can make choosing one much easier for the average investor, whether they are working with an advisor or not. Plus, most investment managers have powerful incentives to make good decisions and turn a profit; in fact, for many, their jobs depend on it.

These asset pools, which are sold as individual securities or shares, are as follows:

Mutual Funds and Exchange-Traded Funds (ETFs)

Both of these are baskets of securities, typically holding equities or bonds, but there are also real estate and commodity funds, among others. They usually hold assets of the same type (e.g., “small-cap stocks” or “long-term bonds”) and provide the diversification within that asset class as I alluded to above.

Mutual funds trade based on end-of-day share price whereas ETFs trade in real time like a stock. I will get into this in more detail in a bit, but most mutual funds are actively managed; i.e., fund managers select and time buying and selling of positions to maximize return. Actively managed funds may have an up-front sales charge (called a “load”) and usually charge a management fee of between .5 and 1.5 percent. Some mutual funds are passively managed; i.e., the fund is tied to the performance of a particular market index. If you buy an index fund, you are purchasing some or all of the funds that are part of that market.

EFTs are usually passively managed, but more actively-managed EFTs are coming on the scene. EFTs are known for their low cost (typically .05 to 1.0 percent) and no up-front sales charges. However, because they can be traded like a stock, there may be a greater temptation to buy and sell at the wrong times. Most people make mutual fund or ETF choices based on diversification and maximizing return for a given risk appetite.

Closed-End Funds (CEFs)

These are similar to mutual funds and ETFs, which are “open-end funds,” meaning that additional shares cannot be issued to meet investor demand, but CEFs release a fixed number of shares which are not redeemable from the fund. Existing shares are bought and sold in the markets. CEFs are actively-managed pooled investments and many use leverage (borrowed money) to enhance returns. That can make them riskier. CEF management fees are higher than mutual funds (typically in the 1.5 to 3.0 percent range). CEF distributions can be higher than other types of funds as payouts can include the usual: interest payments (from fixed-income portfolio holdings), dividends from equity holdings, and realized capital gains; however, unlike other types of funds, they may also include the return of capital. Because they tend to be more complicated than their mutual fund and ETF cousins, invest in them with care (professional advice is highly recommended).

Ethical and ‘green’ investment funds

These are just a specific type of mutual funds. The fund managers make stock selections based on ethical criteria. You may choose one to avoid any allocation of your money to companies whose products you don’t agree with (e.g., cigarettes). However, be aware that some so-called ‘ethical funds,’ especially those that identify themselves as ‘socially or environmentally responsible,’ may have investment philosophies that are not in alignment with biblical teachings or principles.

Asset management styles

Mutual funds and ETFs are managed differently. The most significant distinction is between active and passive management, which describes the level of involvement that asset managers have in the day to day management of the fund.

Until the mid-70s, all mutual funds were actively managed. That’s when the Vanguard Group, under the leadership of John Bogle, introduced the First Index Investment Trust, which was later named the Vanguard 500 because it was based on the S&P 500 Stock Market Index. There were no others until 1984 when Wells Fargo came out with a second index fund.

But my how things have changed! Today, $3Bil. a DAY is going into Passive ETFs and Index funds, and Vanguard has become the largest provider of Index Funds in the world. The Vanguard 500 Index fund now has assets of over $400Bil.

Active Management

Active management means that the fund manager picks the investments and times their buying and selling with the goal of beating the market. Until the passive/index fund revolution, which is largely credited to John Bogle and the Vanguard Group, most mutual funds were actively managed. Moreover, some (but not most) do beat their market benchmarks, especially over long periods of time.

Actively managed funds cover virtually all asset categories and can vary significantly in the management fees they charge. One well-known and respected fund is the Vanguard Wellington Fund (VWENX), which carries a fee of only .17 percent (if you buy Admiral Shares). Another great fund, which I held for a long time in my IRA, is the Fidelity Contrafund (FCNTX). It has an expense ratio of .74 percent, which, although higher than VWENX, is lower than three-fifths of the actively managed funds in its category.

Active fund management has its advantages, especially for certain types of fund in certain kinds of market conditions. Some believe that the markets aren’t always ‘efficient’ (i.e., they don’t price stocks and bonds perfectly), and active managers try to exploit those inefficiencies by finding ‘bargains’ that deliver better returns. They hold more of the investments that they think will do better (i.e., they ‘overweight’), which may take them out of alignment with the benchmark. Actively managed funds usually perform in-depth research and analysis on the companies they buy, which they also believe will lead to outperformance. Some even time the market to “buy low and sell high” to further optimize gains.

Passive Management

Passive management is usually associated with low-cost index funds, so called because they track the performance of their respective market indices. Their goal is not to “beat the market” but to deliver market returns at a lower cost than actively managed funds.

Passively managed index funds are composed of stocks or bonds that partially or fully represent a specific market index. For example, the Vanguard 500 Index Fund mentioned above fully represents the S&P 500 Market Index, which is comprised of the 500 largest companies in the U.S. However, all index funds are not created equal. They use different benchmarks, ways of correlating to them and can vary in management fees. Because their goal is to match the performance of an index, the difference in costs can be a critical factor in overall performance and ultimately selection criteria.

For example, one of the most popular large-cap stock dividend ETFs, the iShares Select Dividend ETF (DVY), currently pays a dividend of 3.85 percent and carries a fee of .39 percent. A similar fund, which I own in my IRA, is the Schwab U.S. Dividend Equity ETF (SCHD), has a current dividend yield of 3.07 percent but a fee of only .07 percent. They would seem to be virtually identical funds, but DVY is based on the Dow Jones U.S. Select Dividend Index, whereas SCHD is tied to the Dow Jones U.S. Dividend 100 Index, which is slightly different.

Passively managed index funds have taken the financial services market by storm. According to a 2016 article by John Bogle,

“Since 2008, index funds have accounted for 160% of net cash flows into equity mutual funds. During those seven years, investors have made net purchases of almost $1 trillion in passively managed index funds even as they have liquidated, on balance, $600 billion of their holdings in actively managed equity funds—a remarkable $1.6 trillion swing in investor preferences. Such a dramatic turnabout in investment strategy is, I believe, without precedent in the mutual fund industry.”

Examples of passively managed index funds are the Vanguard Total Stock Market Index Fund (VTSAX) and the Fidelity International Index Fund (FSIIX).

Active versus passive management – which is better?

There is much debate going on about which is better, active or passive management. There are zealots in both camps. For example, Dave Ramsey has historically been a strong advocate for actively-managed mutual funds with good track records. In contrast, John Bogle, the well-known and widely respected founder of the Vanguard Group, recently said,

“Understand that the markets are unpredictable; don’t get anywhere near leverage for the normal person; don’t spend much time fussing with your portfolio. Buy and hold the total stock market, or the S&P 500, or the total bond market; buy and hold forever, and that is the secret of investment success.”

Mr. Bogle is suggesting that the average investor or advisor can’t “beat the market” as the market is merely the aggregate behavior of all the people investing in the market. In other words, it’s a zero-sum game (i.e., for every winner there has to be a loser). So why bother? Better to save regularly, diversify your investments in market-based index funds, and take what the market gives you because the market has been excellent over the long haul.

Although there is still more money invested in actively managed funds, the pendulum seems to be slowly swinging in favor of passive management. One of the big reasons is that beating the market is hard, really hard in fact. About 80 percent of actively managed funds do not regularly beat their market benchmarks. Plus, actively managed funds tend to charge higher fees than their passively managed counterparts – and costs can add up especially over an extended period.

Investors who want to gain market exposure at the lowest possible cost are increasingly choosing index funds. Companies like Vanguard, Fidelity, and Schwab are seeing huge influxes. Fidelity Investments, where I have my IRA, is one of the largest and most successful providers of actively managed mutual funds. It is also one of the largest providers of passive investments. Like many investors, I think there is a role for both, so I currently have a mix of active and passive funds in my IRA.

Using actively managed fund gives you the opportunity of outperforming a particular index, but it could also underperform. With a passive fund, you know you are going to get whatever the market gives you, and probably at a lower cost. However, neither can guarantee to outperform their benchmarks, and each has done better in some areas than in others. For example, according to the SPIVA, bond funds tend to beat index funds in some popular categories such as investment-grade intermediate and short-term bond funds, municipal bond funds, and treasuries.

There are also some essential differences between the bond and equity markets and how the indexes are constructed and how the securities are prices that tend to favor sold active bond funds.

So, I tend to favor passive index funds for stocks and actively managed funds for bond and alternative investments. Most of my stock funds are passive index funds (such as the iShares International Developed Markets Minimum Volatility EFT, EFAV), but several of my fixed income funds are actively managed. For example, I own PIMCO’s actively managed bond fund, BOND, which is classified as a “total return” bond fund (more on that in the next article). However, I also own the passively-managed iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD), which is tied to an index.

The management fee for the BOND fund is .55 percent (which is pretty low for an active fund) and .06 percent for the SLQD fund, which is much lower. Another reason that I hold these funds is that each of them generates dividend or interest income in the 2 to 3 percent range, which is vital to those in (or near) retirement.

One more to go…

In the third and final article in this series, I will discuss different ways of investing (DIY versus hiring a portfolio manager) based on your specific objective (long-term growth, income, growth and income, etc.).